Checking Out the Benefits Program of Brightway Credit Card: An In-depth Introduction

Introduction

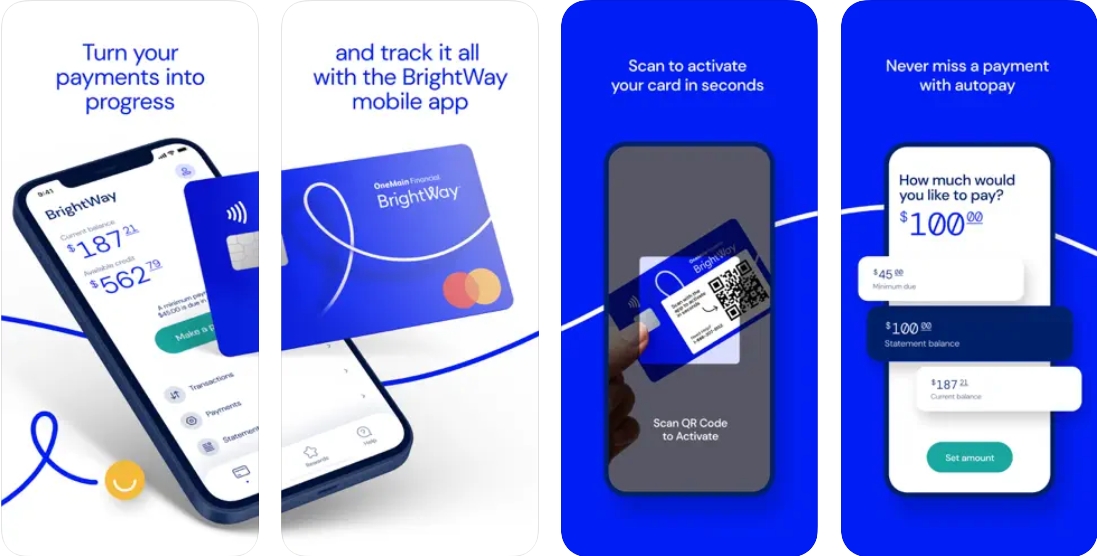

In modern quickly-paced planet, credit cards became an integral Portion of our economical life. They provide us with the comfort and flexibility to create buys and payments devoid of carrying significant quantities of dollars. Brightway Credit Card is one this sort of solution that provides a benefits program to its cardholders. In this post, We're going to choose a detailed think about the rewards method made available from Brightway Credit Card and explore its various attributes, Rewards, and eligibility conditions.

�15,000 Brightway Charge card: A Match Changer

Are Check out the post right here you hunting for a bank card which can provide you with a large credit score limit? Seem no further more! The $15,000 Brightway Bank card is here to meet your economic demands. With an impressive credit score Restrict of $15,000, this card opens up a earth of alternatives. No matter if It can be looking for your preferred devices or planning a aspiration trip, the $15,000 Brightway Charge card has got you covered.

Brightway Credit Card Overview: What makes it jump out?

When it will come to choosing a credit card, it is vital to take into consideration each of the elements that make it exceptional. Let us dive into what sets Brightway Charge card in addition to its competition:

1. OneMain Brightway Bank cards: A Reputable Option

Brightway Bank card is supplied by OneMain Money, a dependable title within the economic marketplace. With their in depth knowledge and experience in giving financial remedies, OneMain Economic makes certain that their charge cards are tailored to fulfill the varied wants of their buyers.

2. Certain Acceptance: No More Rejections

If you've ever faced rejection although applying for the credit card as a consequence of very poor credit score history or not enough credit history rating, get worried no additional! The Brightway Bank card presents confirmed acceptance to suitable applicants. This means that even if you have confronted fiscal problems previously, you could nevertheless take pleasure in the main advantages of owning a credit card.

3. Simple Bank card Software Process

Applying for any credit card should be an inconvenience-free of charge expertise, and that is just what Brightway Bank card presents. The application course of action is simple and will be finished on line. All you have to do is present the necessary details, for instance your personal aspects, employment data, and monetary status.

4. Flexible Credit Restrict Options

The Brightway Bank card supplies versatile credit rating limit selections to suit your specific demands. Irrespective of whether you need a decreased credit limit for day-to-day bills or a higher Restrict for bigger buys, this card has bought you coated. The credit score Restrict is set depending on your fiscal eligibility and creditworthiness.

5. Fast Approval Process

Waiting for days as well as months to Obtain your bank card permitted is often irritating. With Brightway Charge card, you don't need to be concerned about prolonged waiting periods. The approval process is quick, ensuring that you can start taking pleasure in the main advantages of your new card very quickly.

6. Credit history Rating Requirements: A better Look

While the Brightway Charge card features assured acceptance, it's important to know the credit history score demands connected with this card. To become qualified for the cardboard, you should Use a least credit history rating of 620. Nonetheless, even Should you have a decreased credit history rating, you may still be regarded as dependant on other components for example earnings and work security.

Unlocking the advantages: Exploring the Rewards Program

Now that we have explored the assorted facets of the Brightway Credit Card, let's delve into amongst its most attractive attributes - the benefits software! By using your Brightway Charge card for day to day purchases, you'll be able to earn rewards points that may be redeemed for various Positive aspects.

1. Get paid Benefits with Each and every Purchase

With every invest in made using your Brightway Charge card, you receive benefits factors. The more you invest, the more details you accumulate. These factors can then be redeemed for a wide array of rewards such as cashback, journey vouchers, present cards, and even more.

2. Customized Benefits on your Lifestyle

The Brightway Credit Card understands that every particular person has unique preferences and Way of living alternatives. Thus, the rewards method presents various possibilities to cater towards your specific needs. Whether you are a frequent traveler, a shopaholic, or a meals enthusiast, you will discover benefits customized just for you.

3. Competitive Interest Rates

When it concerns credit cards, interest rates play a vital function in pinpointing the general expense of possession. The Brightway Charge card gives competitive interest rates that make sure you can manage your funds successfully with no getting burdened by higher-desire rates.

4. No Yearly Service fees: A price-Effective Choice

Annual expenses can normally consume into the benefits made available from bank cards. Having said that, Using the Brightway Credit Card, it is possible to get pleasure from many of the perks from the rewards method without having to spend any yearly costs. This causes it to be a price-successful selection for individuals who want To maximise their price savings.

Frequently Questioned Inquiries (FAQs)

- A: To qualify for your Brightway Charge card, applicants require to meet specific criteria for example minimal credit history rating requirements and fiscal eligibility. The precise criteria may possibly fluctuate based on person situations.

- A: Sure, implementing with the Brightway Charge card is speedy and hassle-free with a web-based software system obtainable on their own Web site.

- A: The documentation essential might consist of evidence of identification, proof of cash flow, employment information, along with other applicable monetary paperwork. It is always highly recommended to examine the precise needs outlined by Brightway Charge card.

- A: The rewards program makes it possible for cardholders to generate factors on just about every obtain designed utilizing the Brightway Credit Card. These details is usually redeemed for many benefits for example cashback, journey vouchers, and present cards.

- A: The redemption selections and limitations may possibly differ based upon the stipulations on the benefits system. It is recommended to overview This system details provided by Brightway Bank card for certain information and facts.

- A: Sure, it is often useful to match distinct bank card selections before making a call. By comparing capabilities, Rewards, curiosity charges, and fees, you can choose a card that most closely fits your requirements.

Conclusion

In conclusion, the Brightway Bank card gives a comprehensive benefits application that provides benefit on your monetary journey. From assured acceptance to adaptable credit rating boundaries and competitive fascination charges, this card stands out between its competition. By Checking out the rewards plan intimately, you are able to unlock a world of Added benefits customized to the Way of life choices. So why wait? Submit an application for the Brightway Bank card currently and begin reaping the benefits!